When left-leaning or centrist people talk about taxation they often stress tax progressivity, but a progressive tax schedule is not sufficient (or even necessary) to meaningfully reduce inequality. For that you need to raise a lot of tax.

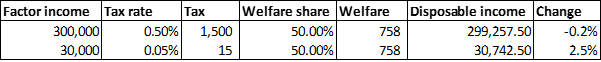

This is easy to illustrate. Say a person on $300,000 pays a hundred times more tax than a person on $30,000 – a highly progressive tax schedule. But if average tax rates are low – say they only pay $1,500 and $15 respectively – there is never going to be much redistribution.

Let’s imagine a mini-society consisting only of the two people above, with tax raised distributed in equal lump sum payments to each. We see the following:

Virtually no redistribution.

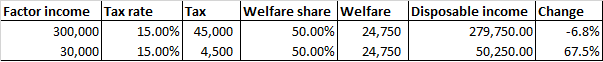

Now let’s examine a flat tax, but at a much higher rate:

Clearly society becomes much more equal with the flat but high tax.

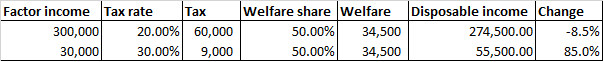

Now let’s look at a higher rate again, but with – gasp – regressive tax:

Even more redistribution!

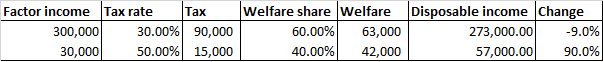

Now let’s look at an extreme: not only will the tax become even more regressive, spending will be targeted at the wealthy (sometimes called “regressive spending”):

And… there’s even more redistribution to the poor! Taxation and spending can both be regressive, yet still produce substantial redistribution from rich to poor. I think that simple result would be counter-intuitive to a lot of people in the policy community.

How is it possible? We need to think about redistribution in a relative, not absolute, way. To reduce inequality, government policy does not need to be pro-poor. All it needs to be is less pro-rich than the market. That is not particularly hard, as the market is very, very pro-rich.

While this is a simple – even banal – point, I believe it is counter-intuitive to a lot of thinking in the anglophone policy community. Its recognition should influence how we evaluate and prioritise policy from the perspective of reducing inequality. My sense is that many policy analysts and advocates who want a more equal society overrate the importance of progressivity relative to sheer bigness of redistribution.

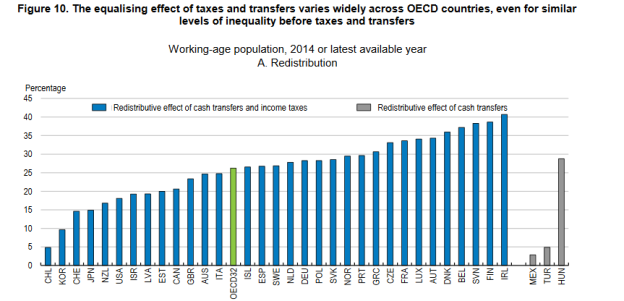

Real world successes in tackling inequality seem to support my point. The most redistributive and equal countries aren’t those with particularly progressive taxation or spending. It’s closer to the opposite.

According to OECD analysis in a 2008 Report Growing Unequal, the world’s most progressive taxing nation is the USA – a notoriously unequal country not known for its socialism. (Discussed here at Club Troppo by ANU Professor Peter Whiteford, who wrote the OECD chapter.)

Australia is up near the top of tax progressivity too. In addition, Australia has the most progressively targeted cash welfare spending. And yet it is not near the top of redistribution. Social democratic leaders such as Denmark, Sweden and Norway have close to the least progressive taxation in the OECD. With universalist welfare systems, their spending isn’t particularly targeted at the poor either. What matters, however, is that they do a lot of it.

To restate my theoretical postulate, the first – and overriding principle – of social democratic tax design is MOAR.

The upshot of MOAR is the critical importance of allocating political and policy-making effort into identifying and promoting relatively tolerated taxes. For a social democrat, it should surpass almost everything else.

Note:

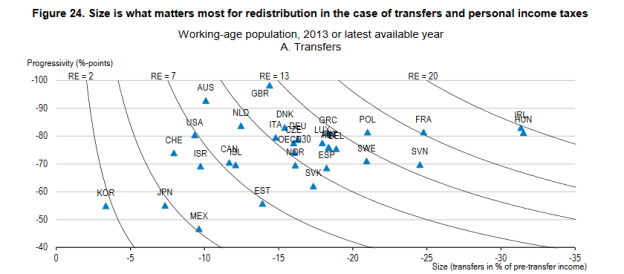

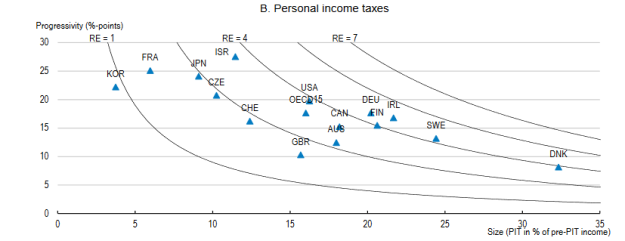

1) The argument that the size of the taxation and transfer system are major variables contributing to the redistribution is a simple mathematical truth. I think this is often under-appreciated. Size is crucial for redistribution.

2) The argument that size is virtually more important than anything else is a normative assertion, relating to social democratic strategy, influenced by some empirical political economy. Some support for it comes from the fact that countries with tax-transfer systems that are not particularly progressive – Finland, Belgium, Denmark, France for example – tend to sit up near the top of world for tax-transfer system redistribution, whereas countries like Australia (the most progressive payments) and USA (the most progressive taxation) are below OECD average for redistribution. This should not imply that any given lower taxing nation cannot be more redistributive than a higher taxing nation (providing it raises enough tax).

How about identifying and promoting taxes that don’t need to raise any revenue in order to produce massive redistribution? A punitive tax on vacant land and unoccupied buildings will massively strengthen the bargaining power of prospective tenants and buyers against incumbent owners, and thereby massively redistribute wealth. But if such a tax is 100% successful in deterring hoarding of land, it will raise ZERO revenue! Let the conservatives try to spin that as a high-tax policy.

LikeLike

Vacancy taxes miss underused land. A land value tax would encourage the most productive use of land and be less gimmicky. Homeowners with huge lots “waste” a large amount of land, yet would probably not pay vacancy taxes.

LikeLike

Pingback: Efficiency is over-rated: lessons from France | Western Sydney Wonk

Pingback: Morales Leads on Doubling Seattle Transit Benefit District Proposal, Colleagues Dither | The Urbanist

Pingback: What to shoot for on welfare and unemployment? | Western Sydney Wonk

Wait what does MOAR stand for? lol

LikeLike