The infamous image of President Suharto accepting painful bailout terms, in front of IMF Chief Michael Camdessus, in 1998.

I’ve been reading up on Indonesia’s economic history, and recently reread Peter Costello’s account of the 1997 Asian Financial Crisis. Peter Costello, for international readers, was Australia’s conservative Treasurer from 1996 to 2007.

Given Costello’s conservatism, it might be a surprise that he is quite critical of the IMF’s 1998 bailout package to Indonesia on grounds of its harsh economic dogmatism.

The Indonesian bailout is a great case study of market-orientated economic policy advice gone wrong. There are lessons not only for the Greek crisis, but also more generally. It serves as a reminder for humility across the economic policy community.

For too long, there’s was a belief that an econ wonk’s job was a narrow one. Just boil down some MICRO101 intuition, cook it up in some best practice policy guidelines, and you have an all-purpose toolkit to fix everyone’s problems. Now brush off your hands, and crack open a beer to celebrate a successful day’s wonking. Empirics? Local context? Ain’t nobody got time for that.

Some people still believe that with a bit MICRO101 intuition, you can simply waltz across any geographic and disciplinary boundary with ready-to-go recommendations on absolutely anything. All you have to do is mouth such phrases as price signals, market mechanisms, government bad, private good etc. Broadly applicable and easy to cook up, it’s the policy advice equivalent of Spam.

After serving up a juicy buffet of MicroSpam, the econocrat can waltz out again, onto a new project, perhaps a new country; leaving others to deal with any disagreeable aftermath that may result from a potentially sub-optimal feast.

The IMF bailouts of the 1990s were the apogee of what’s known as the “Washington Consensus”, which was then the operating philosophy of the IMF, the World Bank and the US Treasury. The Washington Consensus centred on the belief that the key to development was rapidly reducing the role of government in the economy.

Classic policy recommendations included across-the-board privatisations, financial deregulation, social security cuts and trade liberalisation. That is, an all-you-can-eat MicroSpam buffet. Now some of these policies were good, don’t get me wrong. But some were bad, and the good ones tended to be implemented badly.

If governments showed insufficient gusto in gobbling up their MicroSpam, the IMF was not averse to force-feeding. The IMF achieved its greatest influence when it had a country over a barrel. It specialised in loans to desperate governments on the brink of meltdown – with conditions attached to those loans.

While some conditionality is clearly warranted, the IMF notoriously demanded sweeping policy upheaval. It insisted that governments enact received wisdom about many economic nice things, regardless of whether those particular things had any relationship to the crisis, or whether the implementation of these nice things would improve the government’s capacity to repay the loans.

Now the IMF of the 1980s and 1990s had no shortage of lefty critics (occasionally naked). Costello’s commentary, from his 1998 Costello Memoirs coauthored with Peter Coleman (Melbourne University Press), is noteworthy because it is nuanced. It comes from a conservative Treasurer who sympathised with many of the bailout’s goals, but who nevertheless thought it too harsh, overly simplistic and too far-reaching to successfully implement. The bailout, according to Costello, fixated on non-urgent economic reforms, apparently oblivious to local settings and the gravity of the impending human catastrophe. He writes:

But some of the proposals, however admirable, like fully deregulating agriculture, were barely practised in developed countries like the United States and Europe. How Indonesia was going to fully deregulate domestic trade in agriculture within a few months was something of a mystery.

This is basically like your house burning down but the fire authorities won’t come until you pay your library fines. Unfortunately, they don’t take cash and enforce a strict “no charred credit card” policy.

Costello continues:

The Indonesian economic collapse was meanwhile provoking rising prices, food shortages, riots and deaths. The prospect of the country of 220 million people immediately to the north of Australia suffering mass starvation weighed heavily on my mind. This could be a humanitarian disaster…

My view was that Indonesia had to follow a program that would gain the confidence of the international community… But I also took the view that some of aspects of the IMF program were beyond the capacity of the Government and irrelevant to the urgency of the situation. Ending the Clove Marketing Board, for example, would be a structural reform, but in a country on the brink of hyper-inflation and suffering food shortages, the Clove Board was not the problem.

The January program failed to halt the collapse of the rupiah. All of the Budget targets were out of reach almost as soon as they were made. With the economic situation deteriorating so badly there was no way the structural reform would ever be enacted… The conditionality of the Indonesian package was far in excess of that for any of the others. It was clear that many of the conditions would not be met…

Costello goes on to say that the Australian Treasury aligned with the US Treasury, which pushed the IMF to take a hard line. They asked the IMF to ensure that the loans – which Indonesia urgently needed to avoid financial cataclysm – were strictly conditional on sweeping structural reforms.

The Reserve Bank of Australia (RBA, Australia’s central bank) – the more purist and less political of the agencies – rejected this view. It pointed out that the situation was an emergency, not the time for haggling over the specifications of agricultural deregulation. All efforts should go to macro-economic stabilisation to avoid disaster. The RBA even thought that fiscal stimulus might be warranted – precisely the opposite of the IMF’s austerity.

The RBA won the day in influencing Costello, although not to the extent of supporting stimulus:

My view was that Indonesia’s best hope was to cooperate with the IMF to restore confidence in the country, but that the IMF also had to be careful that its prescriptions did not make the situation worse. In my view not enough thought had been given to the sequencing of reforms, to the capacity of the Indonesians to implement them or to separating essential measures from the merely desirable.

Costello’s forthright discussion highlights the way international realpolitik can drive the policy positions of international economic organisations. Some naive journos don’t seem to get this – that organisations like the IMF are actually political organisations, headed by politicians, with political positions (albeit with top research departments):

I put this view strongly to the IMF Managing Director Michael Camdessus when I called him in February 1998. He said he was under immense pressure from the major shareholders of the Fund… “You are at the extreme left,” Camdessus told me. “The G7 is at the right.”…

The United States had been absolutely focused on Korea for strategic reasons. But there was no such strategic issue, as the United States saw it, in Indonesia. Nor was there a powerful Indonesian constituency or lobby in the United States. So the United States was not at all disposed to revisit the IMF program…

In practice, IMF bailout conditions were filtered through the prism of US foreign policy interests.

The results were not good:

Indonesia’s annual GDP growth of around 7% tanked to 4.7% growth in 1997 and suffered a brutal 13.1% contraction in 1998. GDP growth did not break 5% again until 2004.

According to the World Bank, rates of extreme poverty (living on less than $1.25 a day) blew out from 17.6% in 1996 to 23.4% in 1999.

Joseph Stiglitz, who had a front seat view as the Chief Economist of the World Bank, said the terms of the Indonesian bailout “ruined that country’s banking system“. His (now) fellow Nobel Prize winner Paul Krugman said:

The IMF clearly got some of the details wrong–and some of those details were pretty big. It insisted that countries cut spending and raise taxes, a gratuitous deflationary policy that worsened the recession and the situation.

Back to Costello:

In May, the IMF approved the disbursement of US$1 billion in loans… But recovery was slow and painful… Foreign investment collapsed. It would take a decade to revert the levels of foreign investment back again to pre-crisis levels. Meanwhile millions would be thrown back into poverty.

Of the countries affected by the financial crisis in the late 1990s Indonesia suffered the most significant economic setback. Korea rebounded strongly. Thailand was beset by political troubles but it has enjoyed economic growth again. The situation stabilised in the other ‘Asian Tigers’…

The controversy over the Asian financial collapse and the IMF response to it led the IMF in 2003 to conduct an evaluation of its role in Indonesia, Korea and Brazil. It concluded, of Indonesia: ‘In retrospect, the extensive structural conditionality in the January 1998 program became a distraction from taking much needed action on bank and corporate debt restructuring, which was missing from the January program.’

In the euphemistic language of international econocracy, that’s admitting a cluster. Costello:

This is as close to an admission of error as one could expect from an international institution. It recommended: ‘A crisis should not be used as an opportunity to force long outstanding reforms, however desirable they may be in areas that are not critical to the resolution of the crisis.’ This was my view at the time.” [emphasis added]

Or, when the kitchen’s on fire, it’s time to stop grilling the MicroSpam.

Despite wide acknowledgement of the IMF’s mistakes in Indonesia, we’ve recently seen a replay of the MicroSpam buffet approach in Greece. When Greece was teetering on the brink of financial annihilation, the troika insisted the government change its milk labelling regulations (there was excessive transparency). No, this isn’t a joke.

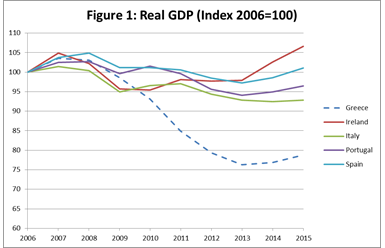

Also high on the economic agenda were pharmacy rules and a bakery deregulation package. Meanwhile the Greek economy contracted by 27%, unemployment sky-rocketed to 27%, and around half the nation’s youth could not find a job, because they were stuck in a crude macro-economic trap imposed on them by European authorities.

The troika started its “structural reform” work in Greece in 2010, promising that after one year of pain the economy would start growing again, due to the “confidence” that the tough measures would inspire.

Greece proceeded to implement the bulk of the reforms, improving the structural budget position by 20%, cutting pensions by 48% and reducing public servant numbers by 30%. Greece implemented twice as much austerity as any other country. From 2010 to 2015, Greece improved by more than 40 places in the World Bank’s ease-of-doing business rankings. According to the OECD (see Figure 1.2 in the link), it implemented more structural reform than any other country. And this is what happened:

So much for a one-year turn around. Free market bakeries just won’t raise enough dough.

Year after year the troika continued to predict a recovery just around the corner. Here’s what happened:

For both Indonesia and Greece, the policy conditions being demanded were so extensive that no real world government could feasibly implement them all. But they did implement the bulk of reforms, and the economic outcomes weren’t close to commensurate with what the econocrats had confidently predicted. Unsurprisingly, their communities felt mislead, that they had agreed to pain on false expectations.

Adding insult to injury was the widespread habit of blaming the victims for the continued economic failure (see analysis here, here, and here). This is the beauty of demanding a reform program so extensive it’s unfeasible for any real world government to fully implement. You can then use the lack of full implementation excuse to explain away all the incorrect predictions, no matter that this claim doesn’t come close to stacking up if you crunch the numbers.

Harvard’s Dani Rodrik, the world’s top ranking development economist, points out the troika’s forecasts were premised on two huge errors. Firstly, they seriously under-estimated the negative impact of austerity on growth in the absence of monetary flexibility (a point the IMF acknowledged in paragraph 41 of this). Secondly, they seriously over-estimated the economic growth that was supposed to spring from micro-economic reform:

The theory behind structural reforms is simple: opening the economy to competition will increase the efficiency with which resources are allocated…

These changes do not directly induce economic growth, but they increase the economy’s potential – or long-run – income. Growth itself occurs as the economy begins to converge to this higher level of long-run income.

Many academic studies have found that the rate of convergence tends to be about 2% per year. That is, each year, an economy tends to close 2% of the gap between its actual and potential income levels.

This estimate helps us gauge the magnitude of growth we can expect from structural reform. Let’s be hyper-optimistic and suppose that structural reforms enable Greece to double its potential income over three years – pushing Greek per capita GDP significantly beyond the European Union average. Applying convergence math, this would produce an annual growth boost of only about 1.3%, on average, over the next three years. To place this number in perspective, remember that Greek GDP has shrunk by 25% since 2009.

So, if structural reforms have not paid off in Greece, it is not because Greek governments have slacked off. Greece’s record on implementation is actually pretty good.

How did the troika get it so wrong? It’s not as if there weren’t plenty of past bailout examples for them to draw from. Dani Rodrik just applies straightforward, orthodox economic calculations in the analysis presented above.

Over-hyping the impact of MicroSpam on economic growth is the Achilles heal of free-market reformers. The dirty secret of economic policy is this: even important economic reforms (that is, not bakery deregulation) will usually only be a blip on the level of GDP over the long-run.

It’s possible that massively over-estimating the benefits of a reform package could increase the chance that a community will sign up to it. But there’s a cost to this: they will never trust you again.

After the bungling of the 1998 bailout, economic rationalists are to this day scorned in Indonesia. In Greece, Syriza was elected on an explicitly anti-troika agenda. It remains to be seen how that situation will eventually play out, but I can guarantee the community will be profoundly sceptical about what they hear from economic institutions.

There’s a few key take-aways here for econocrats.

Firstly, there’s this thing called political economy: governments need to be able to build coalitions of interests, and they need to conserve political capital for most pressing reforms. The alternative is to be booted from office. The troika brought Syriza on itself.

Secondly, it is also important to acknowledge inherent limitations in the administrative capacity of governments. There are only so many sweeping reform agendas they can churn through at once. In micro-speak, bureaucratic capacity is subject to a budget constraint. This applies at every point of the policy cycle, from decision-making through to legislative drafting and implementation.

The Indonesian Government has even acknowledged that there is a trade-off between good economic policy and… killing people. I believe it. As anyone who has worked in a cabinet office or central budget division knows, you have to mercilessly prune even worthy initiatives (that is, not executions) from decision-makers’ agenda. Otherwise, the government will never get its budget out the door, never get a policy up and running.

Thirdly, there’s a thing called democracy. If an international organisation is holding a country over a barrel, a community will (rightfully in my view) resent having its sovereignty compromised on areas of policy not directly related to the crisis. People hate being micromanaged by external authorities, especially when it’s like what happened in Indonesia. Citizens watched on national TV their President acquiesce to an unelected foreign authority, peering over the President’s shoulder like a school master. The political reaction to this will be a lasting set back to the cause of economic reform.

Finally, don’t over-promise and under-deliver. Guard against the temptation to sell beneficial economic reforms as materially improving the growth rate, if they won’t in fact do this.

I wasn’t sure what to make of the RBA Governor encouraging reformers to emphasise “growth” when selling policies that improve allocative efficiency. His argument was that the “public is much more likely to grasp” a growth story. Maybe so, but is that story actually true? I’m certainly not suggesting the Governor is telling reformers to be misleading. From what I’ve heard, he has the highest ethical standards. But I worry that’s how his comments might be interpreted.

Australia’s great economic reforms of the 1980s and 1990s were successfully delivered precisely because communities bought into them. They did this partly because the policies were well explained, and partly because there was a degree of trust for economic institutions and commentators. This will only last as long as Australia’s economic institutions maintain their strong reputation for integrity.

The European economic institutions, in my view, play a tougher game, full of cloak and dagger realpolitik and hardline “fiscal rules”. But it’s all pseudo-toughness, because stakeholders just don’t buy into it. Communities who get burnt quickly stop trusting those who burnt them, and for all the faux-rigidity of eurocrat rules, everyone knows they are just there to be broken.

In my previous life as an Australian Treasury officer, I was always unsure how to respond to inquiries from international organisations about our “fiscal rules”. The reality is that, other than reporting rules, we really don’t have many binding fiscal rules per se. What we have is strong informal institutions: norms of bureaucratic financial accountability, and a public polity that values fiscal discipline. No amount of rules, targets, caps, or bullshit growth forecasts can get you that.

There’s an old saying that a reputation takes a lifetime to build, but only a moment to destroy. The same applies for economic institutions. Integrity and relationships of trust must be prized about all else. Economic reform is indeed something of a political game, but it’s a game with repetitions.

The MicroSpam approach to public policy has contributed to giving econocrats a bad reputation. To be sure, many of the anti-economist attacks are wrong, outdated or overblown clichés, and connected with professional jealousies. As 3LW astutely observed about the social sciences, “The playas gon’ play / Them haters gonna hate”.

Further in defence of econocrats, they are routinely placed in situations where they have no option but to serve up MicroSpam. Econocrats are called on to save the day after things have already gone awry, at the final countdown of a policy time bomb. In the time they have available, there is no choice but to make high stakes judgments based merely on general principles and rules of thumb.

Nevertheless, econocrats must be conscious of these limitations. This consciousness should inspire humility. We know that the data revolution in economics is showing that MICRO101 intuition fails as a general guide to policies in the real world. On a range of high profile issues, from minimum wages to welfare, it will slant our policy recommendations in an overly libertarian direction, relative to the evidence base.

Good econocrats must consciously correct for this bias. Look for evidence, not just neat theory. Furthermore, econocrats must pick their battles judiciously. Avoid demanding others implement know-it-all lists of 150 trivialities. Skip the milk labels and the bakeries. Rather, concentrate on the big fish, policies that we can be most confident about, those that will add the most value to society. Ensure that local practitioners have some discretion in policy choice, with autonomy to adapt it to local situations. Acknowledge the political constraints in which decision-makers operate. Policies must be explained to the community, and a critical mass of support obtained.

Members of a community need to feel that they are agents in economic policy decisions, and that they have reason to trust their economic institutions. Australia has a relatively good history at this.

For all the supposed technocracy of good economic policy, much of it comes down to good norms and ethics; much of it comes down to relationships between people.